Bankruptcy Attorney Tulsa Things To Know Before You Buy

Bankruptcy Attorney Tulsa Things To Know Before You Buy

Blog Article

Tulsa Bankruptcy Lawyer Fundamentals Explained

Table of ContentsSome Known Facts About Tulsa Bankruptcy Legal Services.The Facts About Chapter 7 - Bankruptcy Basics RevealedOur Tulsa Bankruptcy Filing Assistance PDFsTop Guidelines Of Chapter 7 Bankruptcy Attorney TulsaA Biased View of Chapter 7 Vs Chapter 13 Bankruptcy

The stats for the other main kind, Chapter 13, are also worse for pro se filers. (We break down the distinctions in between the 2 enters depth listed below.) Suffice it to state, speak with a legal representative or more near you that's experienced with bankruptcy regulation. Right here are a couple of sources to locate them: It's understandable that you could be reluctant to spend for a lawyer when you're currently under significant financial pressure.Many lawyers likewise provide cost-free assessments or email Q&A s. Take benefit of that. (The charitable app Upsolve can help you discover complimentary appointments, resources and lawful aid absolutely free.) Inquire if personal bankruptcy is certainly the best choice for your situation and whether they believe you'll certify. Before you pay to file personal bankruptcy types and blemish your credit record for up to one decade, check to see if you have any kind of practical choices like debt negotiation or charitable credit report therapy.

Ad Currently that you have actually determined bankruptcy is without a doubt the appropriate program of action and you ideally removed it with a lawyer you'll require to get started on the documentation. Prior to you dive right into all the main bankruptcy kinds, you ought to get your own documents in order.

Best Bankruptcy Attorney Tulsa Things To Know Before You Get This

Later on down the line, you'll actually need to show that by revealing all type of info regarding your financial events. Here's a standard checklist of what you'll need when driving ahead: Identifying documents like your vehicle driver's permit and Social Safety card Tax returns (as much as the previous 4 years) Evidence of earnings (pay stubs, W-2s, independent revenues, income from possessions as well as any revenue from government benefits) Financial institution statements and/or pension statements Proof of value of your possessions, such as vehicle and realty assessment.

You'll desire to comprehend what type of financial debt you're trying to fix.

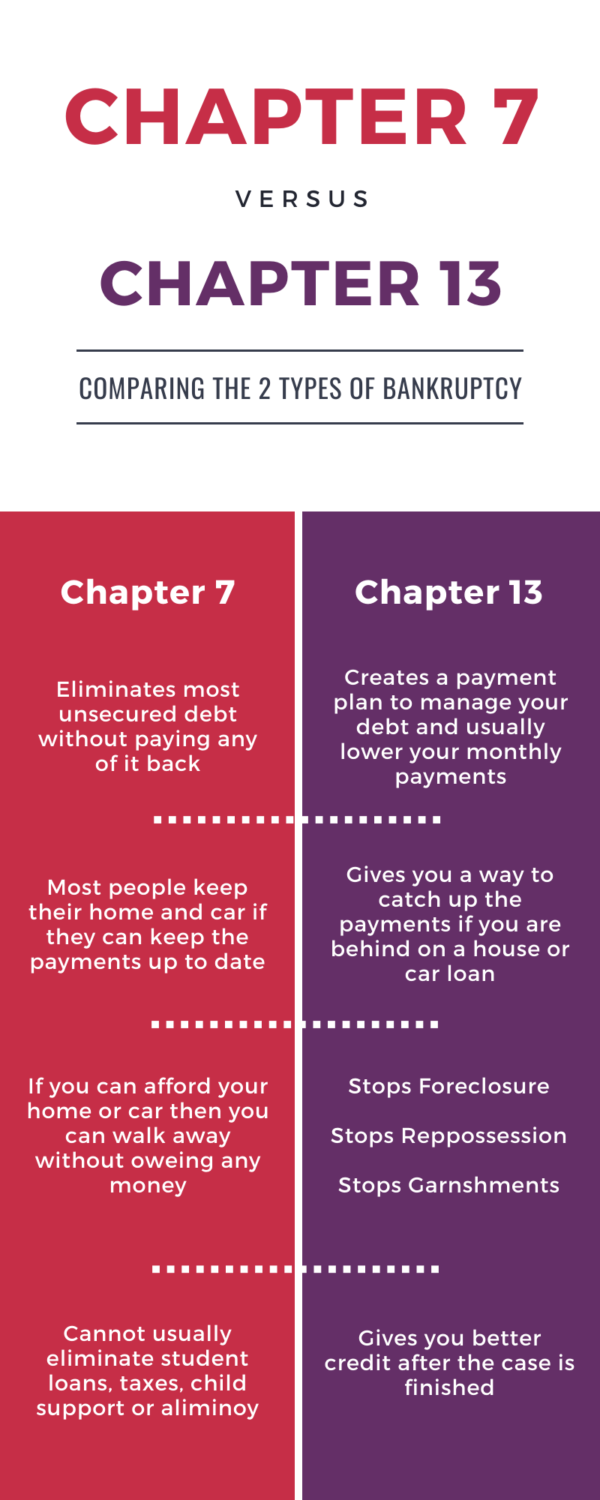

You'll desire to comprehend what type of financial debt you're trying to fix.If your revenue is too expensive, you have another option: Phase 13. This choice takes longer to settle your financial obligations because it needs a long-lasting payment plan usually 3 to five years navigate to this web-site before some of your continuing to be financial debts are cleaned away. The declaring process is also a great deal more intricate than Chapter 7.

Getting The Tulsa Bankruptcy Legal Services To Work

A Phase 7 insolvency remains on your credit scores report for one decade, whereas check out the post right here a Phase 13 bankruptcy diminishes after 7. Both have enduring influence on your credit report, and any kind of brand-new debt you obtain will likely include higher rates of interest. Before you submit your bankruptcy types, you need to initially complete a required program from a credit history therapy firm that has been authorized by the Department of Justice (with the notable exemption of filers in Alabama or North Carolina).

The program can be finished online, in individual or over the phone. You should complete the program within 180 days of filing for bankruptcy.

See This Report on Tulsa Debt Relief Attorney

An attorney will commonly manage this for you. If you're filing by yourself, recognize that there are concerning 90 various personal bankruptcy districts. Check that you're filing with the correct one based on where you live. If your long-term home has relocated within 180 days of filling, you should file in the area where you lived the higher part of that 180-day duration.

Generally, your insolvency lawyer will function with the trustee, but you might require to send out the person files such as pay stubs, tax returns, and financial institution account and credit scores card statements directly. An usual mistaken belief with insolvency is that when you submit, you can quit paying your debts. While insolvency can assist you wipe out many of your unsafe debts, such as past due clinical costs or individual loans, you'll desire to keep paying your monthly settlements for secured financial obligations if you want to keep the residential or commercial property.

Little Known Facts About Which Type Of Bankruptcy Should You File.

If you're at danger of foreclosure and have tired all other financial-relief options, then declaring Phase 13 might delay the repossession and assist in saving your home. Inevitably, you will certainly still require the income to proceed making future mortgage payments, as well as repaying any kind of late repayments throughout your settlement strategy.

The audit could delay any financial obligation relief by a number of weeks. That you made it this far in the process is a suitable indication at least some of your debts are eligible for discharge.

Report this page